Moneyball: Fast Facts About Likely Ratings Participants Who Prefer Country Radio

• It’s Mike O’Connor, NuVoodoo EVP Marketing Strategy, at the keyboard for this week’s Moneyball for Radio.

NuVoodoo’s Ratings Prospect Study surveys thousands of radio format partisans, including ratings-friendly individuals who are modeled for likely participation in PPM or diary methodologies. This small constituency is referred to here as “RPS Yes” listeners. For this particular analysis, our data comes from last quarter’s 24th NuVoodoo Ratings Prospect Study, and our focus is on the subset of RPS “Yes” respondents who prefer the country music format.

The Ratings-Inclined Audience Has Many Country Radio Fans

Over 60% of respondents in this group claim they’d definitely buy a T-shirt, sweatshirt, hat, or other merchandise with their favorite radio station’s logo. Better than seven in ten tell us that radio made them laugh or smile in the past week, and nearly 40% in the past day.

Top Reasons RPS Yes Country Listeners Tune in to Traditional Radio

> “It’s Free” (40%): The top reason cited by country listeners for tuning in is simply that radio is free. Before feeling deflated that ‘free’ is the top value proposition for this audience, consider that it actually serves as an important differentiator from many paid media options, especially given the preponderance of monthly subscription “nibblers.” 80% say they are cutting back on discretionary spending and nearly half in this audience admit to carrying a higher credit card balance in the past year. Times are tough and free matters.

> Keeping Up Locally (30%): Staying informed about what’s going on in the community ranks highly among country listeners, reinforcing radio’s role as a trusted local information source.

> Only Option in Car/Truck (23%): Radio remains a primary source of entertainment while driving, as nearly 23% of listeners cite it as the only available option when in their vehicles. As newer vehicles come online, we’ll likely see this “captive audience” continue to shrink.

> Weather & Traffic Reports (23% and 20%, respectively): Staying updated with practical, real-time information such as weather and traffic continues to be a strong driver for tuning in, especially for listeners who are often on the road.

> Feeling Better or Better Connected to a Station/DJ/Host (20%): Emotional connections with personalities on-air also matter, with 20% of respondents saying they tune in because they feel connected to a host or to brighten their mood.

These insights show that, for ratings-inclined country listeners, motivations like emotional connection, local information, and accessible entertainment can help guide stations to focus more on content that fosters connection, positive feelings, and local relevance rather than branding strictly related to free-money or prize-based promotions (which may be a necessary “evil” for playing the ratings game but scored in the bottom tier of what we tested for radio’s overall appeal).

Radio vs. Music App Listening Behavior

36% of ratings-inclined country format partisans spend the majority of their time listening to FM or AM music radio stations—on a car radio, at home or work, through a smartphone app, or via the station’s website. This equates to slightly better than one in three country fans likely to participate in ratings tuning into traditional radio for the majority of their listening time (16% or just over one in seven of these listeners split their listening time equally between both radio and music apps).

In contrast, 48% of these Ratings Prospect (RPS “Yes”) format partisans dedicate the majority of their listening to music apps such as Spotify, Apple Music, YouTube Music, SiriusXM, etc., in a typical week. That’s slightly less than half of Country’s ratings susceptible audience, indicating a strong inclination towards streaming options over traditional radio.

Digital Streaming Platforms vs. Traditional Radio Listening Time

35% of Country “RPS Yes” format partisans listen for at least four hours a week to digital streaming platforms. This equates to just over one in three country fans dedicating significant time to digital streaming each week.

In comparison, only 15% of these partisans listen for at least four hours a week to FM/AM radio (including traditional or digital distribution). That’s approximately one in seven country fans who spend at least four hours per week listening to traditional radio.

Audio Listening Preferences at Work

35% of Country “RPS Yes” format partisans listen most to an FM or AM radio station on a traditional radio at work. Another 6% listen to FM or AM radio through a computer or smartphone.

41% listen most to digital streaming platforms such as Spotify, Pandora, Apple Music, Amazon Music, or YouTube Music while at work.

12% listen to additional audio sources such as SiriusXM satellite radio, audiobooks, and podcasts.

Only a small fraction of the audience doesn’t listen to audio media while working.

Observation: Nearly seven times as many listeners still consume stations on a traditional radio at work compared to online or via an app. Overall, 41% of all ratings-friendly country listeners agreed they’d listen more to radio stations from any location “if you could use an app,” implying a significant lack of awareness that most stations are accessible via smartphone app.

This highlights an opportunity for stations to promote online methods to overcome signal and reception issues related to building penetration, potentially broadening their at-work reach. In addition, with Nielsen relying on its new companion app to capture more in-tab data in real time, it makes sense for stations to parallel that effort by promoting listening on the station app. Any improvement could disproportionately benefit reach among likely ratings participants in PPM markets due to potential methodology skews.

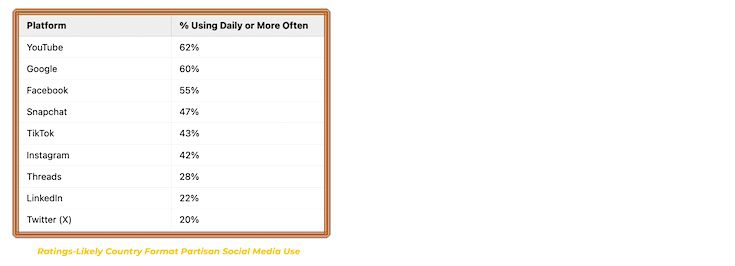

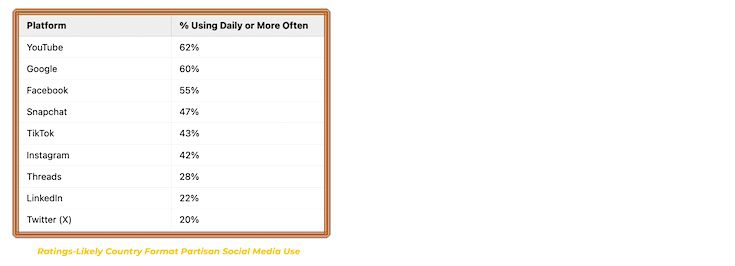

RPS “Yes” (Ratings Likely) Country Listeners on Social Media

Reaching more of this key subset of the audience with greater frequency is paramount for extending listening or increasing occasions in a way that materially impacts ratings. Understanding where the audience is and how often listeners are there improves occasion-boosting marketing performance through organic or paid reach. Posts on YouTube, Google, and Facebook have the potential to reach well over half of the RPS “Yes” Country audience daily or even more often.

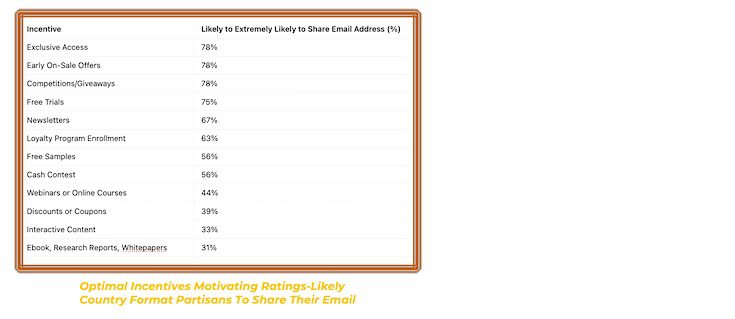

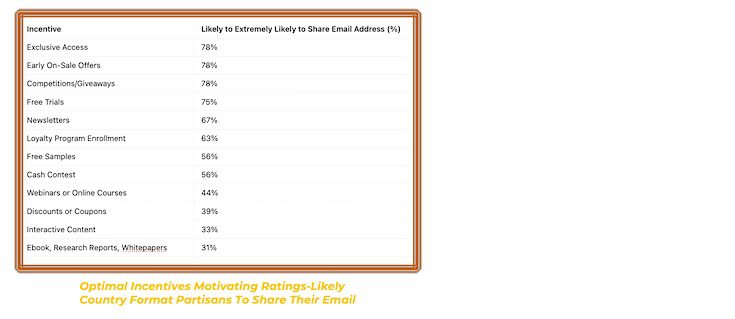

Personal Data Sharing

Collecting email addresses from listeners can be incredibly valuable for radio stations. Not only does it allow stations to set listening appointments and promote exclusive content, but email lists can also be used for custom and lookalike audience modeling on digital ad platforms. This capability helps stations extend their reach, target similar potential listeners, and upgrade engagement both on-air and online.

The top reasons that motivate ratings-inclined country listeners to share their email address include early access to exclusive content, competitions or giveaways, and opportunities for early on-sale offers. Offering loyalty program enrollment or free trials of advertiser products also significantly increases the likelihood of engagement, capturing valuable listener contact details for future promotional campaigns. Unfortunately, despite this willingness to share, only one in ten country ratings prospects recall receiving any email outreach in the past month, with 62% claiming to have never received any at all.

Connected TV/OTT is an Emerging Marketing Channel for Country

A healthy percentage of ratings-inclined country format partisans are spending significant time on ad-supported OTT platforms such as Peacock, Prime, Pluto, and Paramount+. Specifically, 43% of these respondents are watching content for 4 hours or more each week. This level of engagement highlights the upside of using Connected TV (CTV) and OTT video as a marketing channel for radio stations aiming to reach and influence these listeners. View-through rates on Connected TV and OTT platforms tend to be significantly higher than online or on social media video, as watch times are much longer. This provides a unique opportunity for marketers to effectively convey messages.

Tune-in Catalysts

> Advertising: 58% agree that if they see a streaming video or social media post for a radio station advertising a cash contest, they usually tune in even if not directly participating in the contest.

> Switching Due to Advertising: 55% say they switch to try a new station when exposed to any advertising for a format that interests them.

Tune-Out Catalysts

With Nielsen’s adjustment of the minimum listening time to record an Average Quarter Hour (AQH) from 5 minutes to 3 minutes, minimizing tune-out is more crucial than ever for country stations. There are several catalysts that cause this likely-ratings-participant audience to switch stations often or always. Among the most significant are:

> Too many bad songs (48%): Listeners reported tuning out often or always due to hearing too many poorly received songs.

> Burned out songs (39%): Overplayed tracks also contribute significantly to audience dissatisfaction.

> Talking about topics that don’t interest listeners (38%): Keeping content engaging and relevant is essential, as a considerable percentage cited uninteresting topics as a major tune-out factor.

> Commercial breaks (38%): Unsurprisingly, commercial interruptions are a primary reason for listeners to switch stations or stop listening altogether.

> Jokes and skits that aren’t funny (32%): Humor that falls flat is another significant spoken content catalyst that encourages listeners to change the station.

These elements are among the top reasons survey-susceptible country listeners tune out, indicating areas for improvement. While commercials are a necessary part of monetizing radio, other factors such as avoiding repetitive or uninteresting content can be optimized. For instance, horizontal and vertical song repetition are major contributors to dissatisfaction, with 23% of respondents citing horizontal repetition (songs showing up at the same time throughout the week) and 25% citing vertical repetition (songs exposed too frequently throughout the day) as key reasons for tuning out. Ensuring that the station’s song database is well-balanced helps reduce these issues.

NuVoodoo Solutions for Avoiding Tune-Out

Irrelevant talk, bad or burned songs are easily remedied unforced errors that repel Country station partisans. NuVoodoo offers a suite of library music and content testing solutions for under $10,000, and discrete-week current music research ‘callout’ for the same cost that other providers charge for rolling sample shortcuts. Before finalizing your 2025 budget, especially before the first monthly rating period of the new year, let’s discuss how these services can help. Moreover, since we’ve only scratched the surface of the data we have available to help you improve, a direct conversation will be well worth your time.

Reach any member of our team at tellmemore@nuvoodoo.com. You can also watch a series of pre-recorded videos reviewing overall findings from NuVoodoo’s 24th Ratings Prospects Study at nuvoodoo.com/webinars.