BIA 2025 Local Ad Forecast Down 2.4%

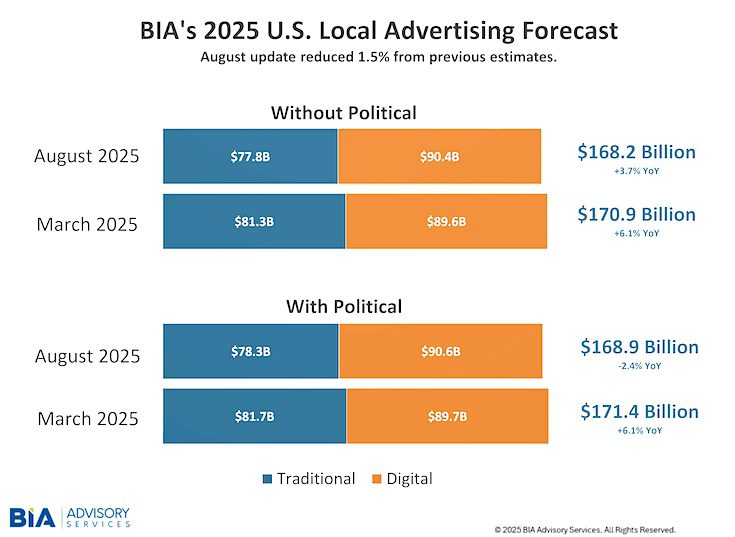

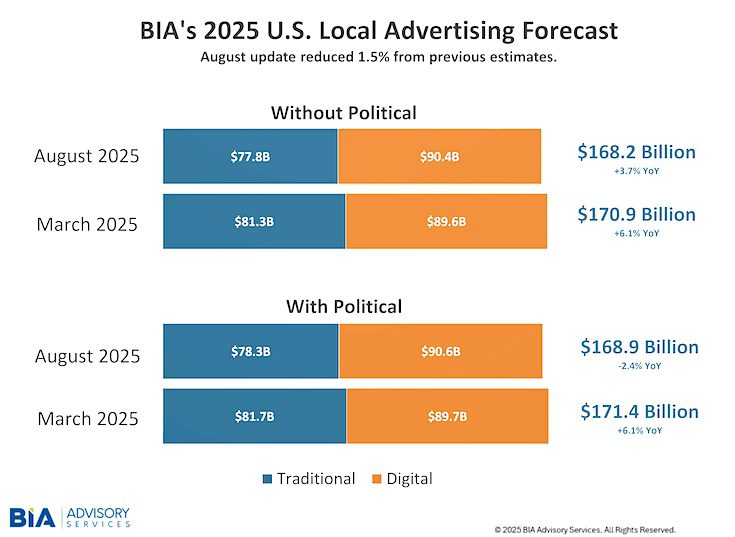

Excluding political advertising, the updated forecast for the year is $168.2 billion, representing a 3.7% growth compared to last year. This amount is a decrease from the previous forecast of $171 billion.

Economic factors such as consumer sentiment, tariffs, high interest rates, and tight credit conditions are exerting increased pressure on local advertising budgets across all sectors, leading to these revised projections. The forecast considers an expected minimum tariff environment of 10%, its impact, and the necessary budget adjustments.

Within the total local ad spend, BIA has raised its forecast for digital media spending by $855 million this year, highlighting its increasing influence in the advertising landscape. Digital media is expected to account for 53.7% of total advertising spending, which amounts to $90.4 billion. In contrast, traditional media spending is projected to make up 46.3% of total ad revenues, totaling $77.8 billion, reflecting a decrease of $3.5 billion from previous estimates. This shift is attributed to a growing focus on lower-funnel channels and the ongoing fragmentation of the media landscape.

When analyzing the forecast without political advertising, several media types are projected to experience growth — Connected TV (CTV) / Over-the-Top (OTT) is expected to increase by 29.3%. PC/Laptop follows closely, growing 12.1%, and mobile advertising is expected to rise by 9.4%. Additionally, TV digital advertising is estimated to grow by 3.7%, while both Out-of-Home (OOH) advertising and direct mail are projected to see a growth of 1.6%.

“The impressive growth of CTV and OTT services from 2024 to 2025 is largely attributed to ad-supported platforms now capturing 73.6% of TV viewing,” said BIA’s Managing Director Rick Ducey. “This transition from traditional broadcasting to streaming reinforces the business case for TV broadcasters to implement CTV/OTT strategies, enabling them to reclaim audiences and enhance their targetable ad inventory. However, despite increasing viewership and advertising spending, streaming providers face significant challenges in achieving profitability in a fragmented market.”

BIA’s local advertising forecast also provides insights into ad spending by local verticals. Key takeaways include:

Top Three Fastest-Growing Categories Year-Over-Year: Real Estate (+10.4%) • Restaurants and Food (+7.8%) • Finance and Insurance (+4.0%)

Key Categories (Excluding Political) Declining Year-Over-Year: Media (-2.2%) • Healthcare (-0.5%) • General Services (-0.3%)

Mele remarked, “Despite the challenges faced by the media sector, there are promising opportunities this year, particularly with the holiday shopping season expected to kick off in early November. This extended timeframe allows for a more strategic approach to targeted advertising. We’re excited to explore these trends further and provide our clients with insights that can help them capitalize on the growth in fast-growing categories while also navigating the declines.”

BIA ADVantage™ is the company’s comprehensive local advertising revenue platform, providing immediate access to forecasts for all local television and radio markets across 16 media types and 96 vertical categories. Clients can log into the platform to view the updated 2025 U.S. Local Advertising Forecast for nationwide and local market estimates. For subscription inquiries, please email mailto:advantage@bia.com.

The nationwide forecast for 2025 can be purchased HERE.