Moneyball: CHR and AC P1 Deep Dive

• Last week we shared a deep dive into findings concerning Urban and Urban AC P1s from the latest NuVoodoo national study. We’ll continue this week with a deep dive into P1s for CHR and AC radio.

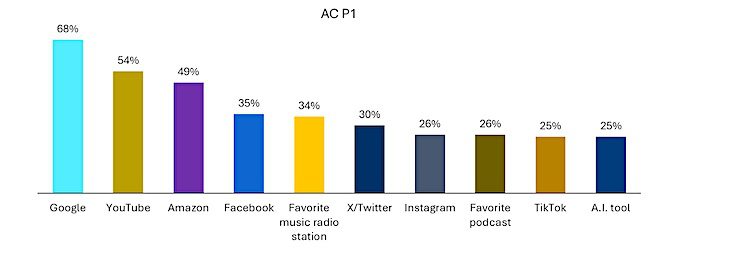

Among AC P1s, their favorite music radio station ranks a distant fifth, well behind Google, YouTube, and Amazon — but just a tick behind Facebook — when asked how important over two dozen various digital and media entities are in their daily lives.

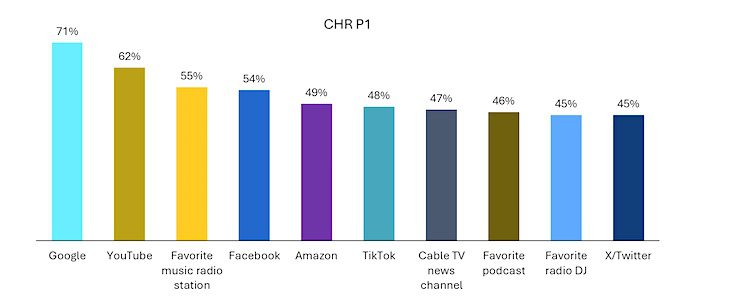

With its more foreground presentation, however, their favorite music radio station ranks third among CHR P1s, behind Google and YouTube (and just a tick ahead of Facebook). Radio appears twice in the top ten ranking of CHR P1s, with their favorite radio DJ nosing in ninth, just behind their favorite podcast.

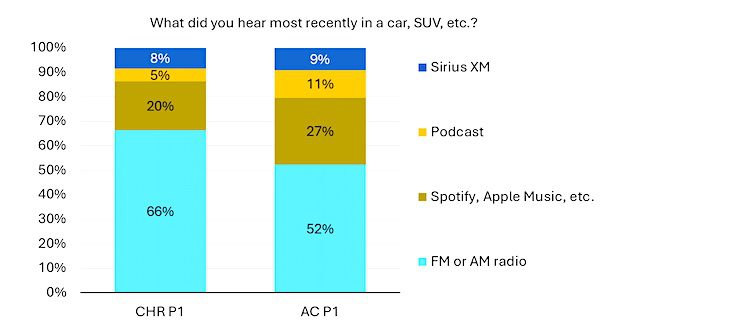

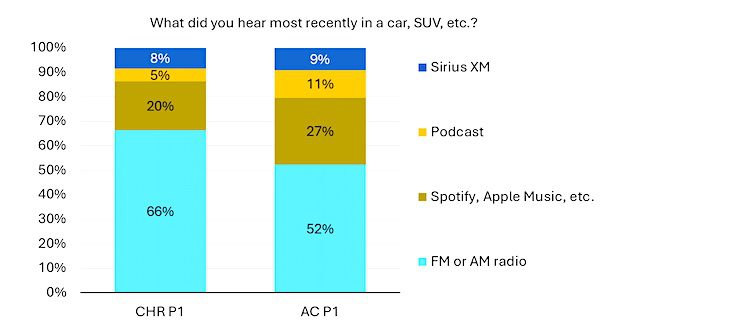

Radio is the last thing that most (52%) AC P1s heard in a vehicle, with streamers like Spotify being the last thing heard by just over a quarter (27%) of that group. Radio jumps 14 points among CHR P1s, while streamers drop 7 points. It’s worth noting that AC P1s are twice as likely as CHR P1s to say a podcast was the last thing they heard while on the road.

There are lots of listening choices in current generation vehicles — and some don’t easily default to radio, even when it’s the last thing that was on. Stations need to air reminders focused on genuinely entertaining events upcoming to remind listeners what they’ll miss if they don’t tune back in later or come back tomorrow. If it’s a no-brainer to produce, it may be easy to ignore on the air.

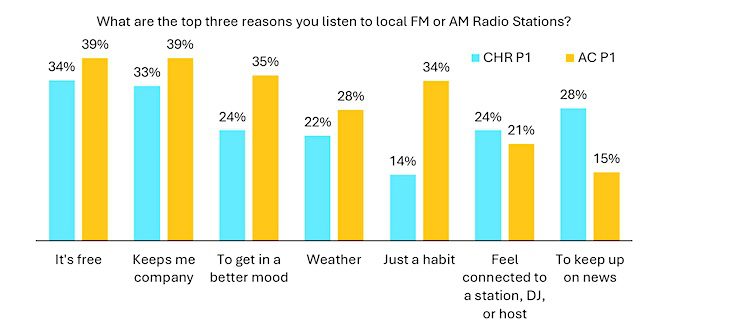

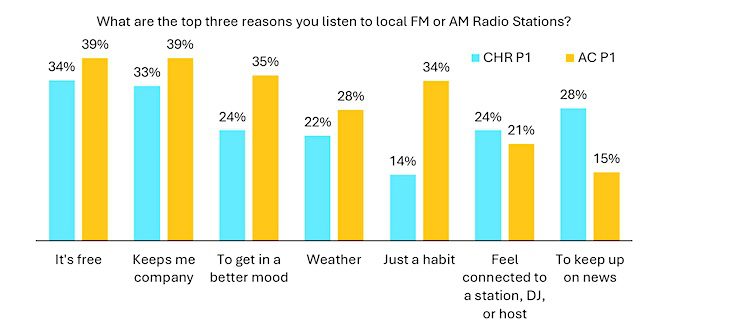

Close to two in five AC P1s include zero cost and companionship when asked their top three reasons for listening to radio. Better than a third cite mood improvement and habit. CHR P1s concur (at slightly lower levels) about no cost and companionship but keeping up on news noses in at third among this group.

Weather is more likely to be a draw for AC P1s, while feeling connected to a station or DJ is several points more common among CHR P1s. While CHR P1s may not be making the case for hourly news updates on CHR, it’s important to know that these are listeners who are likely to consider their time listening to radio as a place to get caught up.

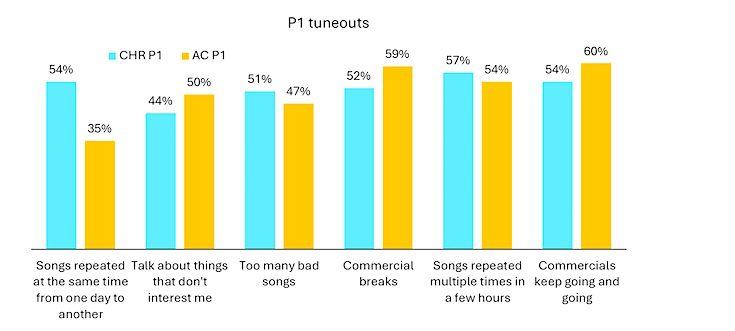

CHR P1s most frequently cite music repetition when asked why they tune out or change stations — and commercials are only a few points less likely to be named. AC P1s more often cite commercials, but music repetition is next on their list. In 2025 (and beyond), music selection is best guided by any metric that provides solid feedback on music from listeners to your station in your market.

National streaming stats can provide insights into what songs are getting interest from fan groups worldwide, those stats don’t provide an accurate reflection of tastes among a local radio audience.

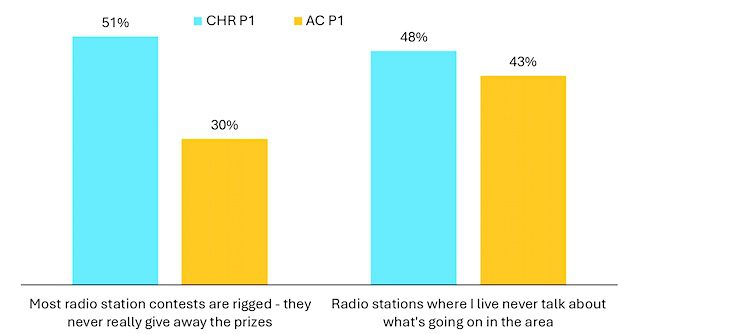

CHR P1s are skeptical about the legitimacy of radio contests. About half of the CHR P1s complain radio station contests are rigged, that the prizes are never really given away. Stations should work vigorously to get winners on the air frequently and showcase the neighborhoods, workplaces, etc. of winners to prove legitimacy and enhance listener attitudes.

Nearly half the CHR P1s in our sample and over two in five AC P1s note that stations never talk about what’s going on in their area. An element as simple as weather can help combat this perception. Highlighting station appearances, including concert dates of format-appropriate bands coming to town, quick mentions of weekend activities in the area are all examples of how to push back on the perception that your station doesn’t talk about what’s going on.

We’ll wrap up these deep dives next week with a look at Alternative and Rock P1s.

If you’re worried about music selection problems on one of your brands, NuVoodoo has library tests starting at $9500 and barter options available in many markets. An email to leigh@nuvoodoo.com will get you a quick response.