Moneyball: Rarer Ratings Respondents, Rarer Heavy Listeners

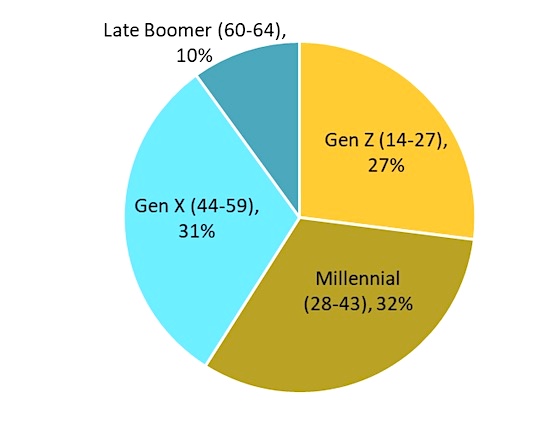

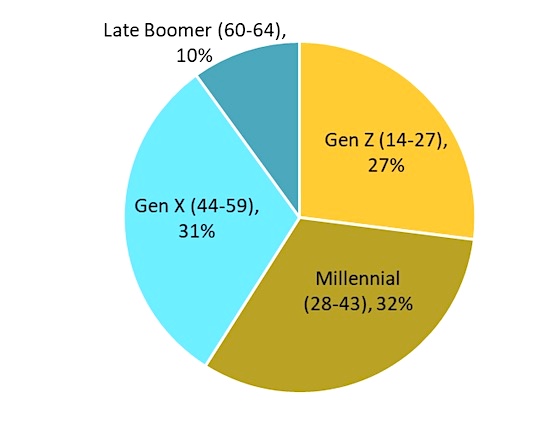

Our new study was fielded May 29 — June 1, 2024 and includes data from 3,188 respondents aged 14-64 nationwide — yes, up to age 64 so that we have a look at all of Gen X (now aged 44-59) and the youngest five years of Baby Boomers – A/K/A “Late Boomers.”

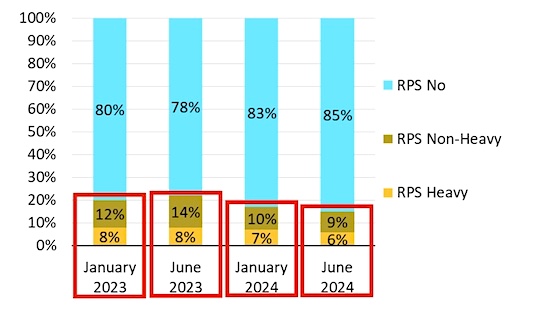

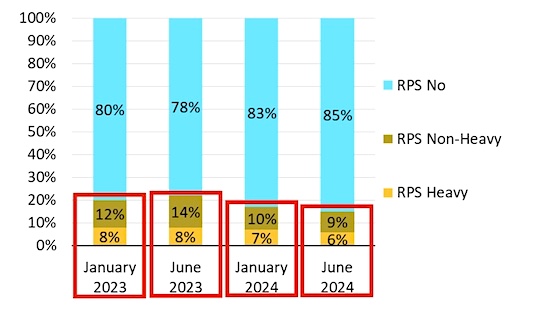

In the chart below, the percentage who profile as likely ratings participants — among an already research-friendly sample – are labeled “RPS Non-Heavy” and “RPS Heavy” (outlined in red) and total 15%, down from 17% earlier this year and at least 20% in two studies in 2023. The “Heavy” designation is reserved for those who listen to broadcast radio at least an hour a day and are the ones you’ll be relying on to help you move the meter in the ratings.

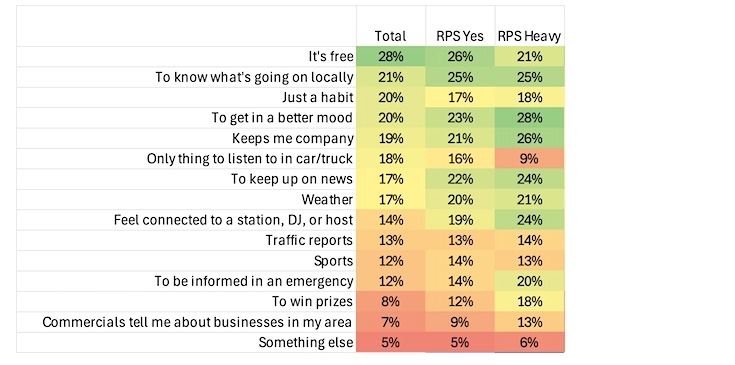

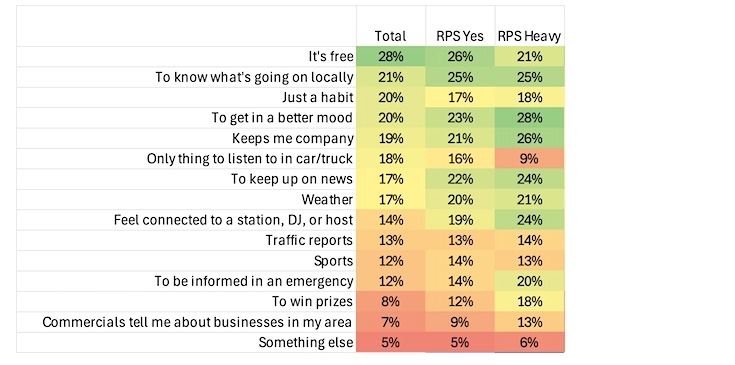

As noted last week, station marketing efforts will be made more difficult as ratings respondents become even harder regardless of whether you’’re relying on a partner like NuVoodoo to help with your marketing efforts or using your own expertise. Those RPS Heavies are the ones you’ll be after – likely to participate in the ratings and with enough TSL to the medium to help you build AQH rating. When we ask the top three reasons people listen to radio, among the RPS Heavies the top answers are mood enhancement, companionship, to know what’s going on locally, news, and a connection with a station or host.

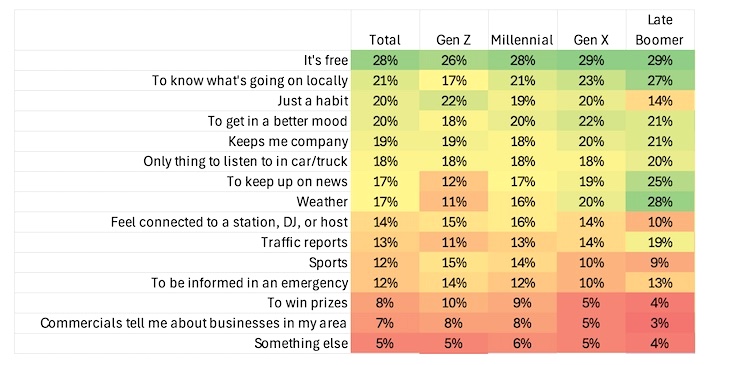

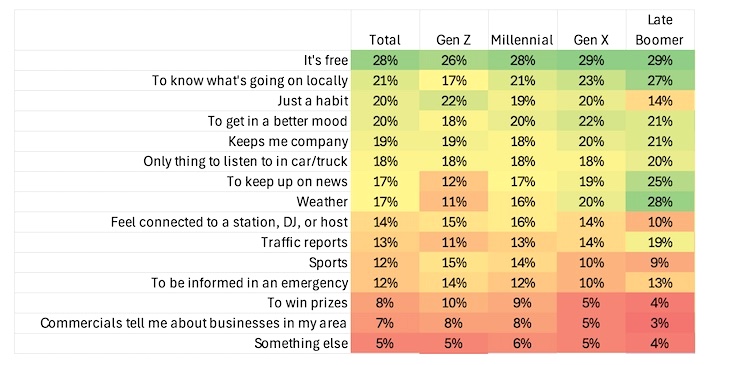

When we open to the entire sample, you’ll see that the priority to know what’s going on locally and news is driven by older listeners, but there’s no demographic charge to mood enhancement. And Late Boomers are less likely to feel connected to a station or host compared to younger generation members.

Connection between listeners and stations/hosts arise isn’t about demographics … it’s about affinity and exposure. Does the station or host resonate with those who tune in? Radio tilts the table in its favor when it uses research to determine which songs to give the greatest exposure. Great hosts understand the tastes and interests of their audiences. Great managers and programmers use every resource they can to learn about their listeners.

Meanwhile, we’re looking at lots of ways stations can get listeners to share their email addresses or mobile phone numbers in Ratings Prospects Study 24. While marketing budgets are important, we also recognize that these days First Party Data is becoming critical. For a business that’s been preoccupied with P1 (first-preference listeners) for so many years, it’s a switch to be talking about 1P (First Party Data). Collecting that contact information, earning permission to communicate with listeners, and maintaining a steady stream of welcomed information is key to radio’s future. We’ll be sharing the results of Ratings Prospects Study 24 in the weeks ahead to help radio shape programming, promotion, and marketing plans for its fall report card from Nielsen. Questions? Contact Leigh Jacobs at Leigh@nuvoodoo.com.