Moneyball: Rarer Ratings Respondents, Rarer Young Demos

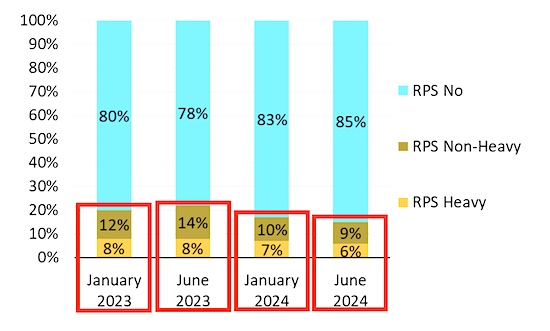

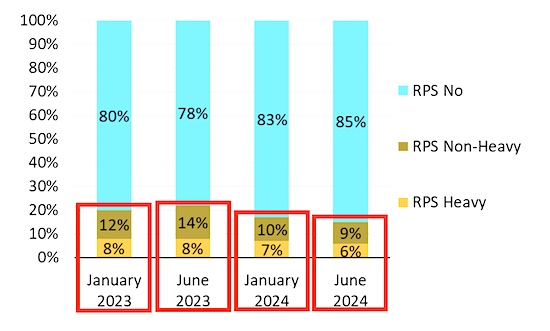

Last week the second release from NuVoodoo Ratings Prospects Study 24 showed that on top of a decline in those interested in participating in radio ratings methodology, there’s a decline in the heavy broadcast radio listeners among that group – from 8% last year, to 7% earlier this year, to 6% in this latest study (as shown in the chart below).

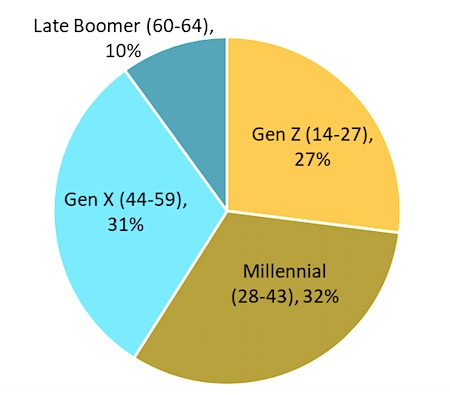

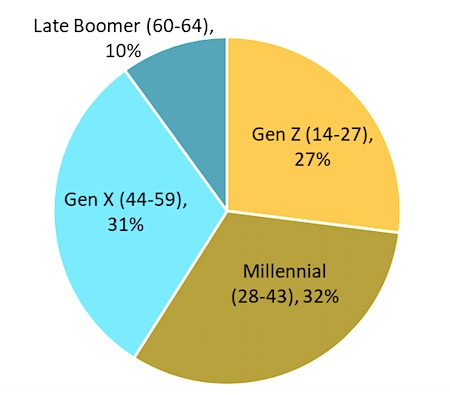

Keep in mind, our latest nationwide sample, fielded May 29 – June 1, 2024, includes data from 3,188 respondents and goes from age 14 up to age 64 nationwide. In the sample we have all but the very youngest of Gen Z and all of the Millennial generation. This higher age limit at the older end allows us to look at all of Gen X (now 44-59) and the youngest five years of Baby Boomers (labeled “Late Boomer” in the chart below).

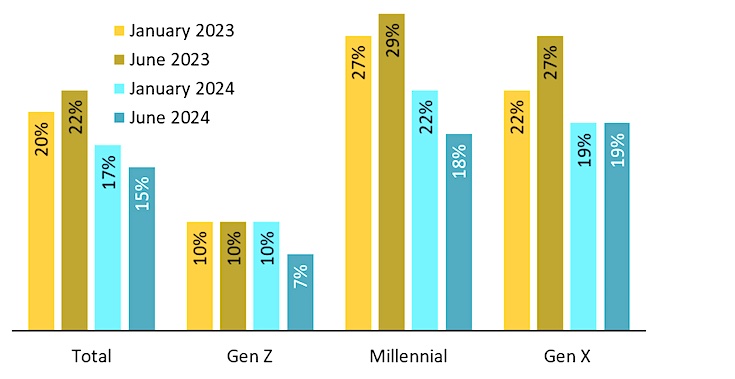

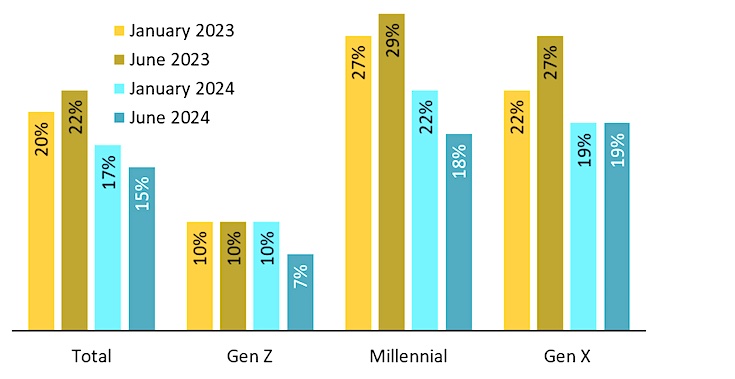

We’ve never published the demographic details of our findings concerning proclivity to participate in the ratings, since our data – and that published by ratings services – are weighted back to proportionality with the overall population. But the data collected this year changed our position. For the chart below we’re considering only the 14-54s in our latest study, so that it should line up perfectly with our past samples of 14-54s. It shows that Gen X has settled in at just about one in five participating, while the two younger generations are slipping: Millennials just under one in five and Gen Z to fewer than one in ten.

(In case you’re wondering, the percentage of Late Boomers in our new sample who say they’d participate matches the overall number: 15%.)

Station marketing efforts will be made tougher this fall as the election drives up CPMs. Whether you rely on a partner like NuVoodoo to help with your marketing efforts or use your own expertise, finding those who are likely to be participating in the ratings sample – and generate sufficient TSL to the medium to help you build AQH rating – will be your mission. It’s a mission that will have little tolerance for error.

While marketing budgets are important, we also recognize that these days First Party Data is becoming critical. For a business that’s been preoccupied with P1 (first-preference listeners) for so many years, it’s a switch to be talking about 1P (First Party Data). Collecting that contact information, earning permission to communicate with listeners, and maintaining a steady stream of welcomed information is key to radio’s future.

We’ll be sharing more results of Ratings Prospects Study 24 after the Fourth of July holiday to help radio shape programming, promotion, and marketing plans for its fall report card from Nielsen. Stay safe across the holiday weekend!