Moneyball: Ratings Respondents are Getting Rarer

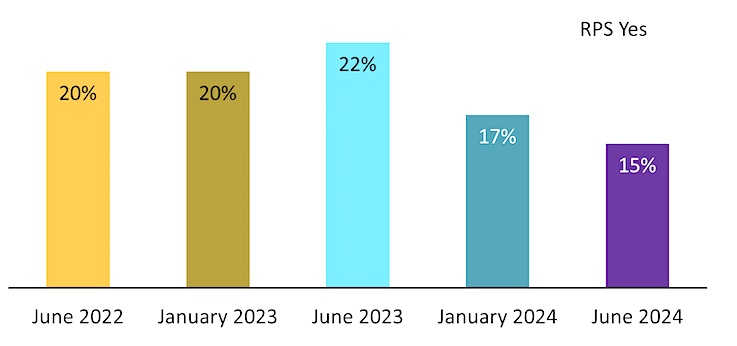

• The percentage of people interested in participating in radio ratings methodology continues to ebb. In the latest national study from NuVoodoo, Ratings Prospects Study 24, the percentage who model through as likely to participate in metered or diary methodologies drops from 17% in January of this year to 15% in the latest study. Ratings Prospects Study 24 was fielded May 29 — June 1, 2024 and includes data from 3,188 respondents aged 14-64 nationwide.

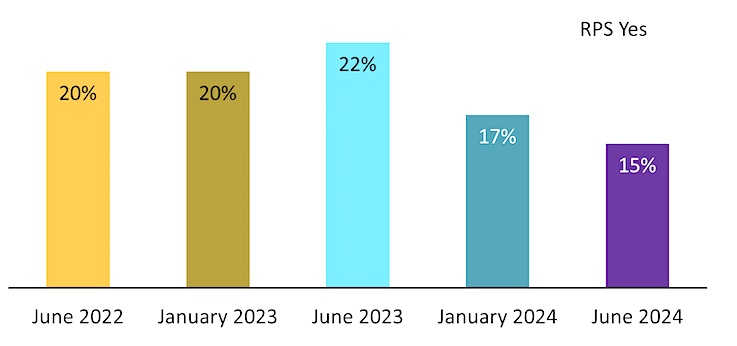

Labeled “RPS Yes” in the chart below, the percentage who profile as likely ratings participants — among an already research-friendly sample — is now at 15%, down from 17% earlier this year and at least 20% in two studies in 2023.

This suggests that ratings samples will be further challenged as the ratings services work to maintain profitability in a less cooperative environment. Station marketing efforts will be made more difficult as ratings respondents — proverbial needles in a haystack — become even harder to find. While stations that place digital media buys on behalf of clients can do the same for themselves at CPMs below what they’d pay for managed services, this narrowing of the likely ratings respondents makes it even more critical that targeting is absolutely optimal.

To duplicate NuVoodoo’s approach to targeting, you’d start by profiling the anonymized data of tens of thousands of radio research respondents across a dozen formats while paying close attention to the subsets showing the greatest proclivity toward participating in a ratings-type study. You’d extrapolate those insights to the wider universe and use them to model a look-alike audience in your market. This would allow you to target more precisely, reduce wasted impressions, and increase the odds of connecting with people who can meaningfully impact your ratings.

With spring ratings results starting to roll out July 9 and the fall book starting September 12, most markets will have less than two months to make fall marketing plans. Station budgets are under extraordinary strain during this election year with inventory in high demand — increasing CPMs and reducing the margin for error.

To try to mitigate these challenges we came up with a plan that relies on client stations for a few basic items. This allows us to reduce our time commitment and offer a solution at a CPM closer to what stations can buy on their own while using NuVoodoo’s targeting. The needs from the station end becomes routine: demo, Zips, IAB-compliant elements (we provide a list), run dates, and budget. There’s a modest one-time setup fee and a minimum spend, but the CPM for a highly targeted campaign with spend split evenly between display and video is $13.50.

This basic service starts at $4945 including a $500 setup fee and a minimum spend of $4445 and has delivered outstanding results for clients. For a higher CPM, our team is ready to provide deep guidance on targeting, Zip Codes, and best practices on messaging, artwork, and video. Additionally, at the higher CPM we’re able to make campaign adjustments during the run of the program and manage the timetable from end to end.

Meanwhile, we’re looking at lots of ways stations can get listeners to share their email addresses or mobile phone numbers in Ratings Prospects Study 24. While marketing budgets are important, we also recognize that these days First Party Data is becoming critical. For a business that’s been preoccupied with P1 (first-preference listeners) for so many years, it’s a switch to be talking about 1P (First Party Data). Collecting that contact information, earning permission to communicate with listeners, and maintaining a steady stream of welcomed information is key to radio’s future. We’ll be sharing the results of Ratings Prospects Study 24 in the weeks ahead to help radio shape programming, promotion, and marketing plans for its fall report card from Nielsen. Questions? Contact Leigh Jacobs at Leigh@nuvoodoo.com.