Moneyball: The Battle for In-Car Listening

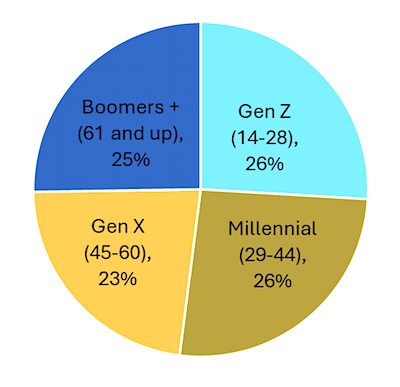

• We made a few changes when we fielded our first national study for 2025: NuVoodoo National Media & Marketing Study 25. The sample is still massive — over 2900 respondents — but the demo is wider. We still start at age 14. But instead of ending the sample at age 54, this one has no top end. We’re able to include the entire Baby Boom — and as much of the Silent Generation as we can get in a study conducted online. Yet three quarters of the sample is comprised of members of generations younger than Baby Boomers, and a third of the sample is 55+.

The interview covers a lot of ground: Audio and video platforms in use • Latest trends in Social Media, including purchases made there • Video device usage, including short-form video • Ad attention across a wide swath of marketing channels • Music discovery • Podcasts, including platforms • Use of digital assistants • AI: early adopters, attitudes, concerns • And audio media being used in cars

Broadcast radio started with a massive advantage in the car: a largely captive audience, easy and intuitive to use devices, a wide range of programming choices up and down the dial, good audio quality on AM and very good audio quality on FM. Radio has survived encroachment from other technologies over the decades: 8-tracks, cassettes, CDs, SiriusXM, etc. But many current generation in-vehicle audio systems demote FM and AM to make it easier to connect with digital audio options — or stream directly from the driver’s smartphone.

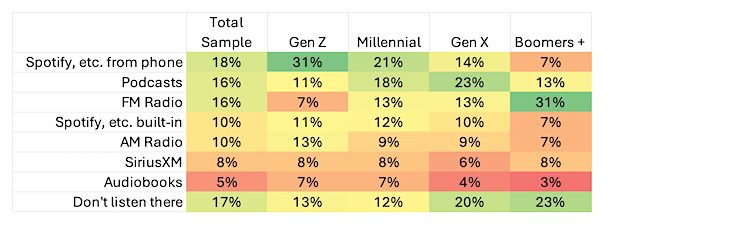

We gave respondents a panel of seven in-vehicle audio source options and asked, “Roughly what percentage of the time do you listen to each of these in a car, SUV, or truck?” We know going in some respondents will exaggerate usage of newer sources and under-report older sources. Yet even with that expectation, the competition for in-vehicle listening is clearly fierce.

The prompts in our interview spelled out many streaming providers beyond Spotify, but we’ve shortened the labels in the table below. We indicated that we weren’t concerned how they were connecting to podcasts – just that they were listening to podcasts while driving. And, for this case, we weren’t concerned whether they were connecting to broadcast radio programming over the air or via internet.

About 1 in 6 don’t listen while driving and just over a quarter of the time spent listening is spent with broadcast radio — sharply higher among only the oldest segment of the sample, the 25% of the sample aged 61 and up. Podcasts eclipse AM radio (and possibly all spoken-word radio). And Spotify and its competitors account for over a quarter of in-vehicle listening time, whether streamed from a smartphone or a native app in the vehicle.

Radio has stiff competition on the road. In one-on-one interviews we’ve conducted, whether to use the Bluetooth connection to stream a phone or to simply listen to the radio is determined by the length of the drive and other factors. Years of budget cuts have reduced the goodwill for or even recognition of on-air talent. Radio must play the odds the best it can on every song and every break. Shifts that have been pre-recorded can work much of the time but may not work as well if there’s a change in the weather or breaking news. Programmers need to build options and keep their stations nimble to remain ahead.

We’ll be releasing results from this latest study in the coming weeks at nuvoodoo.com/articles, including important insights from NuVoodoo marketing guru Mike O’Connor. We’d love to help your stations stay ahead of the competition with our effectively priced offerings for both marketing and research. An email to tellmemore@nuvoodoo.com will get you quick attention from the right member of our team.