Moneyball For Radio: 9/11/23

Moneyball & Listening Devices

Moneyball for Radio means working to find that next tenth of an AQH Ratings point to bring your station to the next level for your sales team. It means using everything at your disposal to tilt the table in your favor in pursuit of that next tenth.

Our latest NuVoodoo Ratings Prospects Study was fielded June 28-July 1 earlier this summer with a sample of 2,504 respondents ages 14-54 nationwide. Just over a fifth of these research-friendly respondents model as being likely to empanel with Nielsen if offered into a meter or diary sample. They’re labeled “RPS Yes” in the charts and tables in this article and deserve our attention, since they’re the people most likely to give stations their report cards.

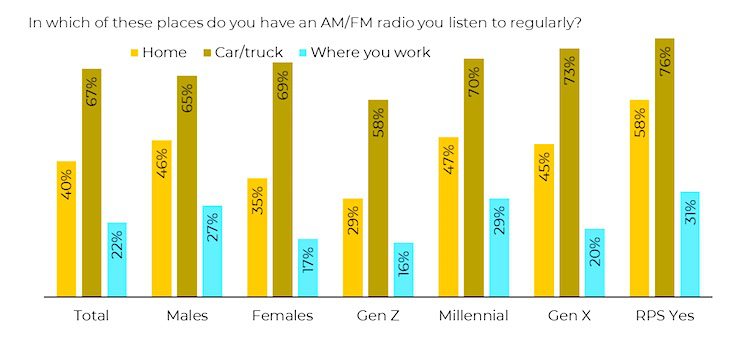

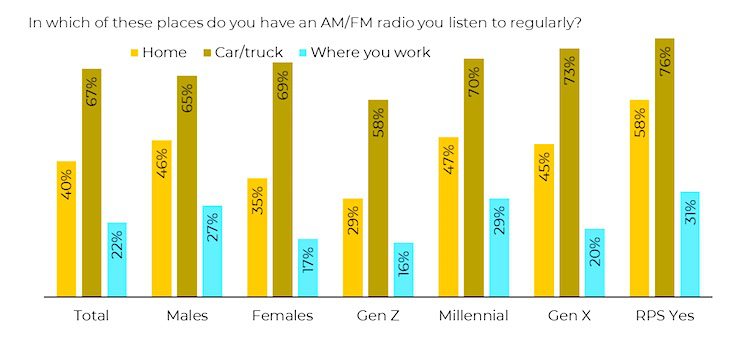

While vehicles remain the stronghold of broadcast radio, radio is no longer ubiquitous there. Many newer models demote radio’s position in the center stack. Radio is no longer the only choice; it’s often no longer even the default choice. Stations have to earn each and every listening occasion. In the chart below, 67% of our sample say they have and regularly listen to a radio in their car or truck. Broadcast radio is aided by the ratings-likely portion of the sample – those labeled “RPS Yes” – where 76% say they have and use a radio in their vehicle.

More ratings-likely respondents (“RPS Yes”) also have and use a radio in their homes (58% compared to 40% across the entire sample) and at work (31% compared to 22% for the total sample). As Gen Z (ages 14-26 in this sample) furnishes their first homes, those homes are unlikely to have a radio. Gen X (ages 44-54) is more likely to have a radio at home, but new or replacement radios aren’t easy to purchase. Try going to Best Buy and telling one of the blue-shirted attendants that you’d like to buy a new radio.

For many, the new audio device at home is a smart speaker. Scripting what to say so listeners know exactly what to ask Siri or “Hey Google” to play for them is good business. Imagining all the ways they might ask their smart speaker to play your station and ensuring your station will play anyway is even better business. Regularly monitoring your stream for audio quality and user experience is critical.

The attention to your stream will also pay dividends for those trying to listen at work, where personal listening is often the norm or, in shared environments, where more Bluetooth speakers are connected to someone’s smartphone.

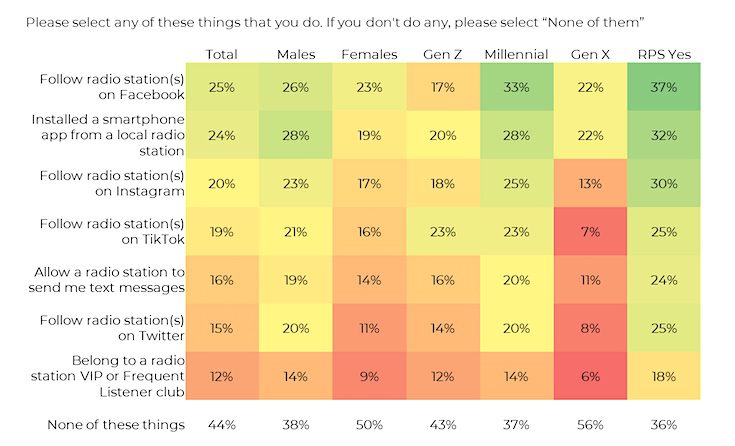

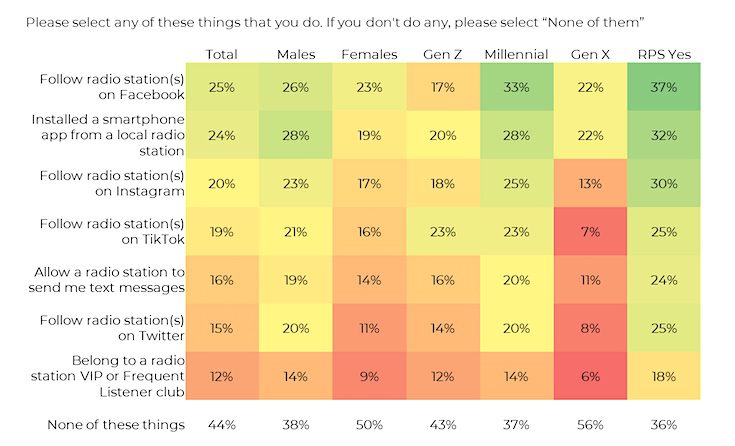

When we asked respondents in what ways they might connect with a radio station, fully a quarter said they follow at least one station on Facebook. Nearly as many say they’ve installed an app from a station on their smartphone – almost a third among the RPS Yes ratings likelies. The question is, does your audience understand all the benefits of your station’s app? We may think it’s implied that they can use the app to listen … but do they realize that?

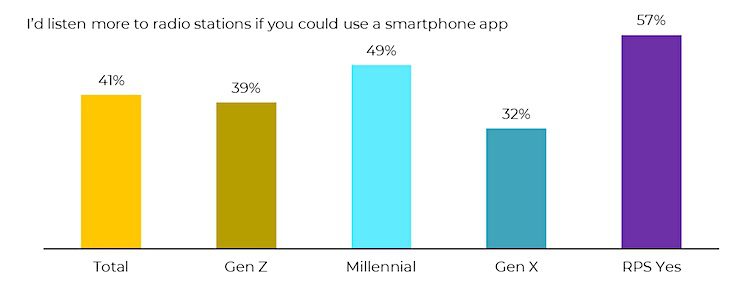

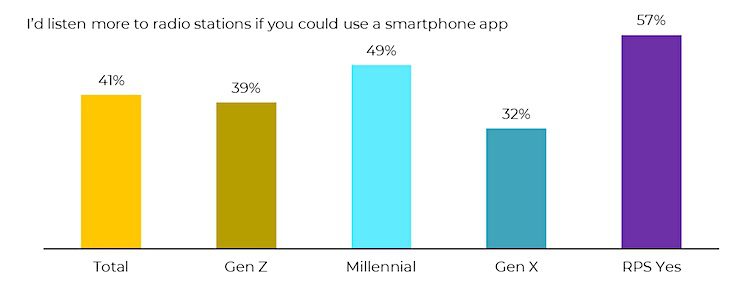

When asked to agree or disagree with the statement, “I’d listen more to radio stations if you could use a smartphone app,” 41% overall agreed; nearly half among Millennials (ages 27-43) and well over half among those most likely to be included in the ratings sample. Trying to get credit for listening via these non-traditional paths in PPM can be a challenge, but making sure it’s easy for a wannabe listener to connect with your station whenever they wish is an important step.

The radio business was easier when radio was just about the only thing you could listen to in a vehicle; when people thought about equipping another room in their home with a new radio; when a table radio allowed an entire office to be entertained by a radio station. Then it was a matter of making your station the best choice among competitors up and down the dial. Radio has all sorts of new competition now – and your station has to stand out among all of them. — To learn more, please visit NuVoodoo.com.